Prof. Peter Quartey

Professor Peter Quartey of the Institute of Statistical Social and Economic Research (ISSER), University of Ghana, has urged policymakers to impose a strict debt ceiling, implement prudent financial management strategies, and strengthen institutional oversight over the country’s resources.

He is also emphasising the need for greater transparency in public procurement and better planning for capital projects to avoid misallocation of resources.

Prof. Quartey made the recommendations when he delivered a thought-provoking analysis of the nation’s borrowing practices and its effects on investment and growth at the 2025 Ghana Academy of Arts and Sciences Inaugural Lecture, where the growing debate over Ghana’s debt sustainability took centre stage.

Under the theme “Debt, Investment, and Growth in Ghana: Did We Borrow to Consume?”He examined whether Ghana’s increasing debt levels have translated into productive investments and concluded, invariably, that they have not.

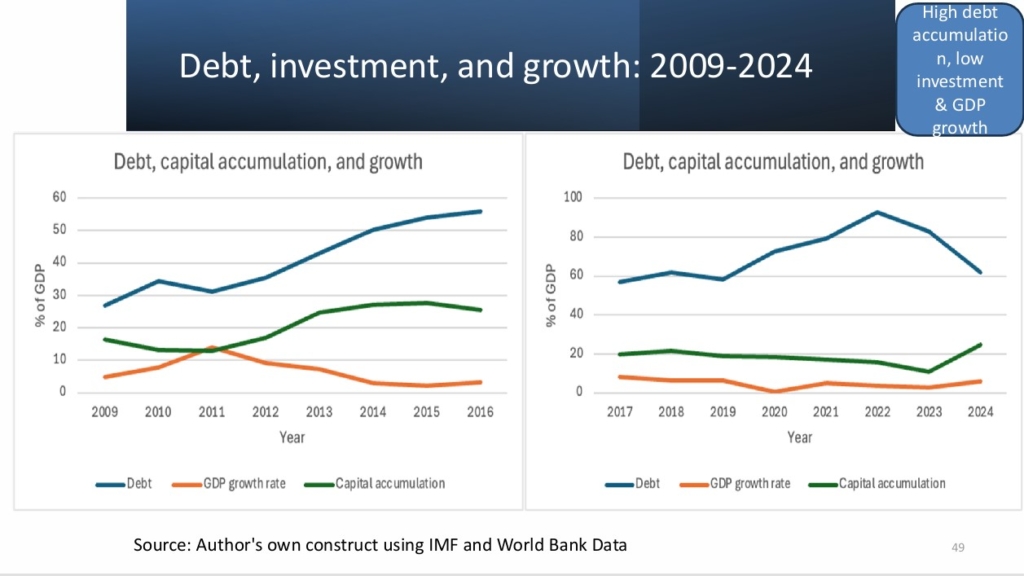

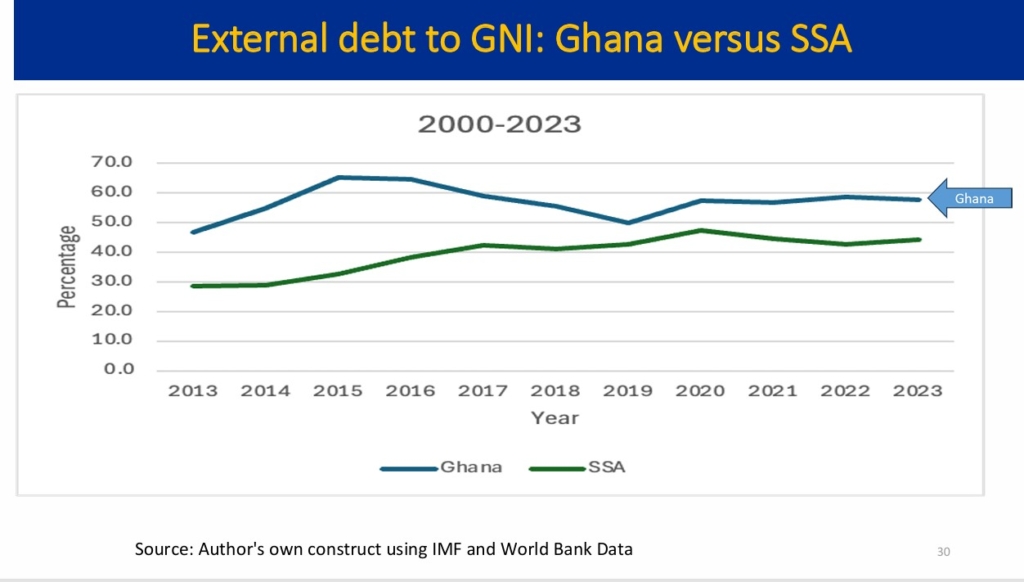

Over the last decade, Ghana’s debt-to-GDP ratio has soared, reaching unsustainable levels.

He argued that while borrowing is a crucial tool for financing development, Professor Quartey stressed that its benefits depend on how effectively funds are allocated.

Prof. Quartey argued that excessive debt can act as a “tax on investment,” thereby discouraging economic growth if it is not properly managed.

Ghana’s capital expenditure, which should ideally drive infrastructure and economic expansion, has plummeted.

In 2010, it stood at 6.9% of GDP, but by 2023, it had declined to just 2.4%. Despite securing substantial loans, the country has struggled to invest in long-term growth projects.

Professor Quartey used three case studies to illustrate the importance of financial discipline, recounting the story of an extravagant tech entrepreneur who squandered his fortune, and contrasted it with that of Ronald Read, a modest janitor who accumulated wealth through strategic investing.

The lesson, he said, was clear: financial success hinges more on behaviour than intelligence, a principle that he said also applies to national economic management.

Ghana has undertaken several major projects funded by external loans, including the Sinohydro and Afreximbank agreements. However, many of these initiatives have faced delays and cost overruns.

He said the Pwalugu Multi-Purpose Dam project, for instance, meant to improve electricity generation and irrigation, is yet to take off six years after its approval, raising questions about the efficiency of public investment

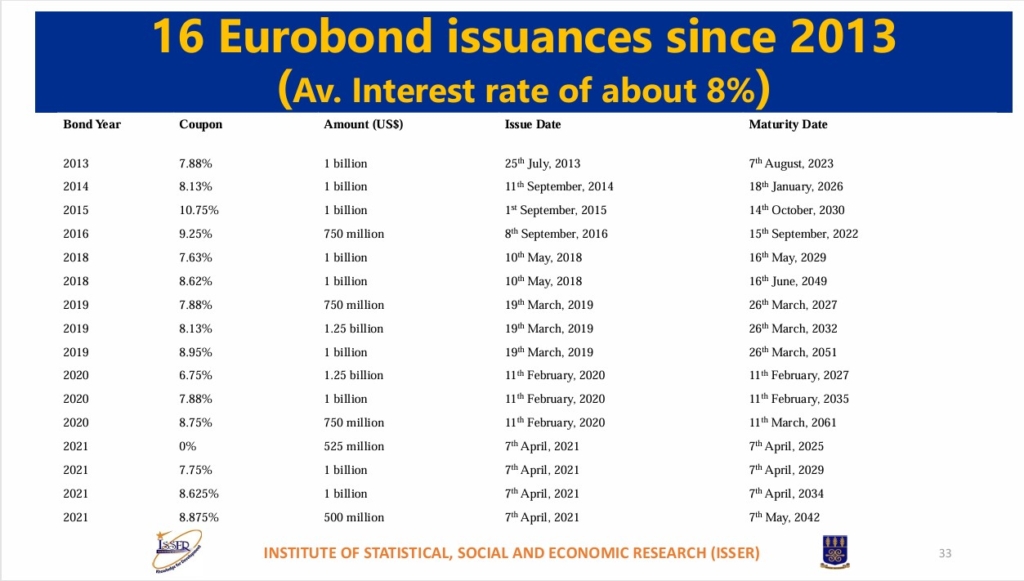

Prof. Quartey also highlighted the shift in Ghana’s borrowing patterns, with a move away from concessional multilateral loans towards expensive international capital markets.

This shift, he argued, necessitates a critical reassessment of whether borrowed funds have been invested in high-return investments or merely used to service existing debts and fund recurrent expenditure.

He cautioned against the government returning to the capital market any time soon.

“The efficiency of investment is paramount. Ghana’s challenge is not merely borrowing but how the funds are allocated and managed,” he noted.

He also pointed out instances of inefficiencies in public financial management, citing extravagant expenditures and the lack of competitive procurement processes.

Beyond the need for debt ceiling, Prof Quartey also called for the strengthening of public financial management and diversifying exports to reduce reliance on external borrowing.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.