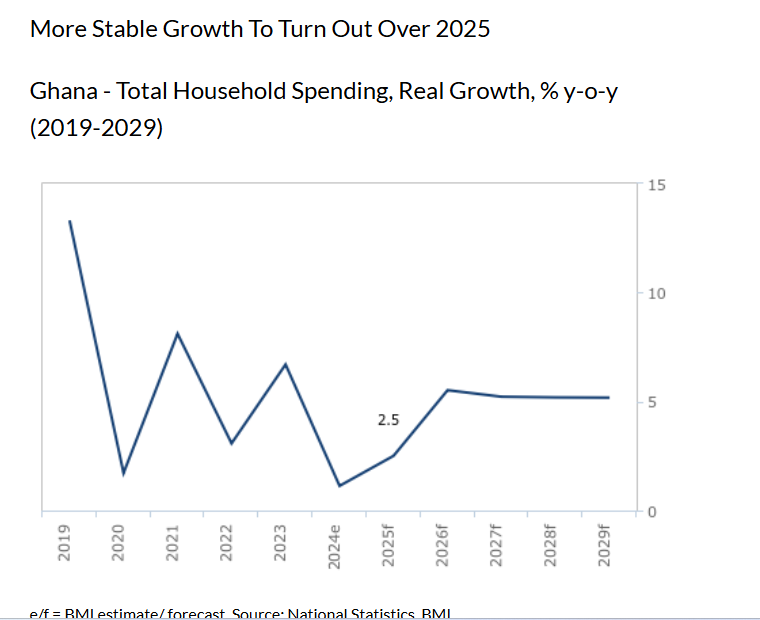

Ghana’s real household spending will grow by 2.5% year-on-year in 2025, following weak growth of 1.1% in 2024.

According to Fitch Solutions, this will result in total household spending expanding to GH¢129.7 billion, 25.4% above the GH¢103.4bn recorded (pre-pandemic) in 2019.

The UK-based firm pointed out that the major drivers of growth will be cooler inflation and greater cedi stability over 2025, while also allowing for a dovish approach from the Bank of Ghana (BoG).

“We will see an improvement in Ghanaian household spending over 2025, as household rally from elevated inflation and cedi weakness. Following the presidential elections in December 2024, consumer activity is already beginning to rebound, and with cooler levels of price growth, greater cedi stability and a dovish approach from the Bank of Ghana, households will see a marked uptick in purchasing powers and will support a rebound in both essential and discretionary segments”.

High Frequency Data: Post-Election Consumer Activity On The Rise

In December 2024, the volume of mobile money transactions grew to a record high of 745.0 million transactions over the month.

This is considerably higher than the July 2024 reading of 678.8 million and highlights the growing level of consumer activity, particularly in the wake of the December 2024 presidential elections.

“While inflation remains a key driver of the growth of the value of mobile money transactions, the rate of growth is considerably above the level of inflation and is therefore pointing to a consumer recovery story, which is reflecting in strong spending growth figure over H2 [second half] 2024 and into 2025”, Fitch Solutions alluded.

It concluded that alower inflation over 2025 will further fuel spending growth and a greater number of transactions and will also see tailwinds from lower debt servicing costs.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.