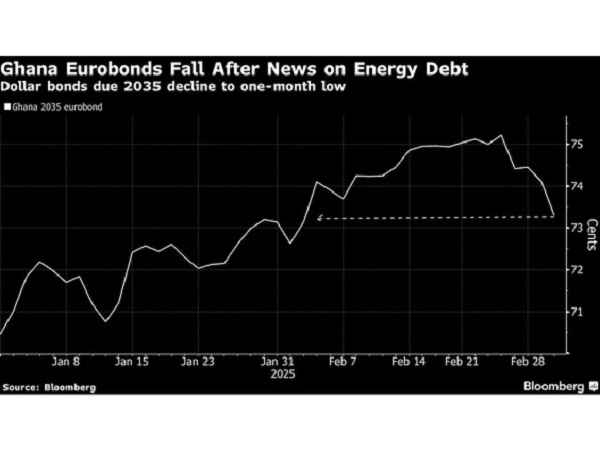

Ghana’s dollar bonds maturing in 2035 dropped 1.1 percent to 73.3 cents on the dollar in London

Ghana’s dollar bonds maturing in 2035 dropped 1.1 percent to 73.3 cents on the dollar in London

Ghana’s eurobonds fell on Tuesday, March 4, 2025, ranking among the worst-performing in emerging markets following a warning from Minister of Finance Dr. Cassiel Ato Forson that the country’s energy debt could double by 2027 without urgent intervention.

According to Bloomberg data, Ghana’s dollar bonds maturing in 2035 dropped 1.1 percent to 73.3 cents on the dollar by 1:02 p.m. in London, marking their lowest level in a month. Similarly, securities due in 2030 declined by 0.9 percent to 77.83 cents on the dollar.

Speaking at the recently concluded National Economic Dialogue on March 3, 2025, Dr. Ato Forson emphasised the need for “radical measures” to prevent Ghana’s energy sector debt from ballooning to $9 billion by 2027.

The finance minister attributed the rising energy debt to inefficiencies at the state-run Electricity Company of Ghana (ECG), including distribution losses, weak revenue collection, limited competition in power generation, and tariffs set below production costs.

For instance, the state-owned power distribution company [ECG] had outstanding obligations of $4.5 billion at the end of 2024. Currently, ECG accounts for only 62 percent of the energy it purchases for resale.

Ghana, which restructured most of its GH¢737 billion ($47.5 billion) public debt including eurobonds back in October 2024, is still negotiating with some 60 international banks to restructure an additional $2.7 billion in loans.

Meanwhile, President John Dramani Mahama has pledged to rein in government spending, fine-tune the IMF’s $3 billion economic recovery program, and restore investor confidence.

MA