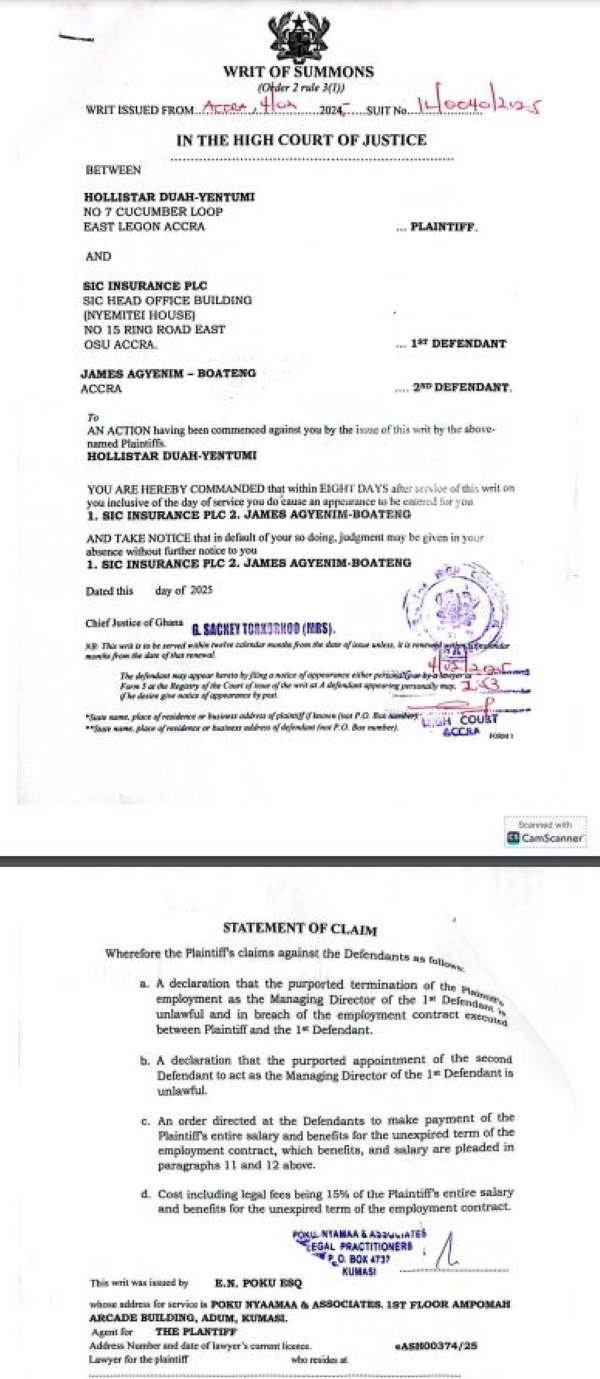

In a dramatic turn of events, the immediate past Managing Director of SIC Insurance Company Limited, Hollistar Duah-Yentumi, has filed a lawsuit against the company and its newly appointed Managing Director, James Agyenim-Boateng.

The lawsuit, filed on February 4, 2025, challenges the termination of her employment and the subsequent appointment of Agyenim-Boateng, which was announced by President John Dramani Mahama on January 27, 2025.

Duah-Yentumi, a lawyer by profession, argues that her tenure as Managing Director was contractually secured for a period of four years, expiring on January 1, 2028, or as otherwise agreed upon by the Board of Directors.

She contends that her employment was governed by a contract dated March 21, 2024, and an addendum dated May 2, 2024, which stipulated that her position could only be terminated by the Board of Directors or by a resolution passed by all shareholders at an Annual General Meeting.

According to the lawsuit, her termination was unlawful as it was executed through a letter from the Office of the President, signed by Executive Secretary Callistus Mahama, Ph.D., on January 24, 2025.

The letter, referenced as OPS 127/25/149, was received by Duah-Yentumi on January 27, 2025, and purported to terminate her role while appointing Agyenim-Boateng as her successor.

Duah-Yentumi asserts that this action violated the terms of her employment agreement. She is seeking a declaration from the High Court that her termination was unlawful and in breach of her contract.

“Regarding the termination of the Plaintiff’s employment, Plaintiff states that under and by virtue of clause 7 of the agreement, the Plaintiff’s employment may only be terminated by the Board of Directors of the 1st Defendant or by all the shareholders of the company acting at an Annual General Meeting for the said purpose,” the suit reads.

Additionally, she is challenging the legality of Agyenim-Boateng’s appointment, arguing that it was not conducted in accordance with the company’s governance procedures.

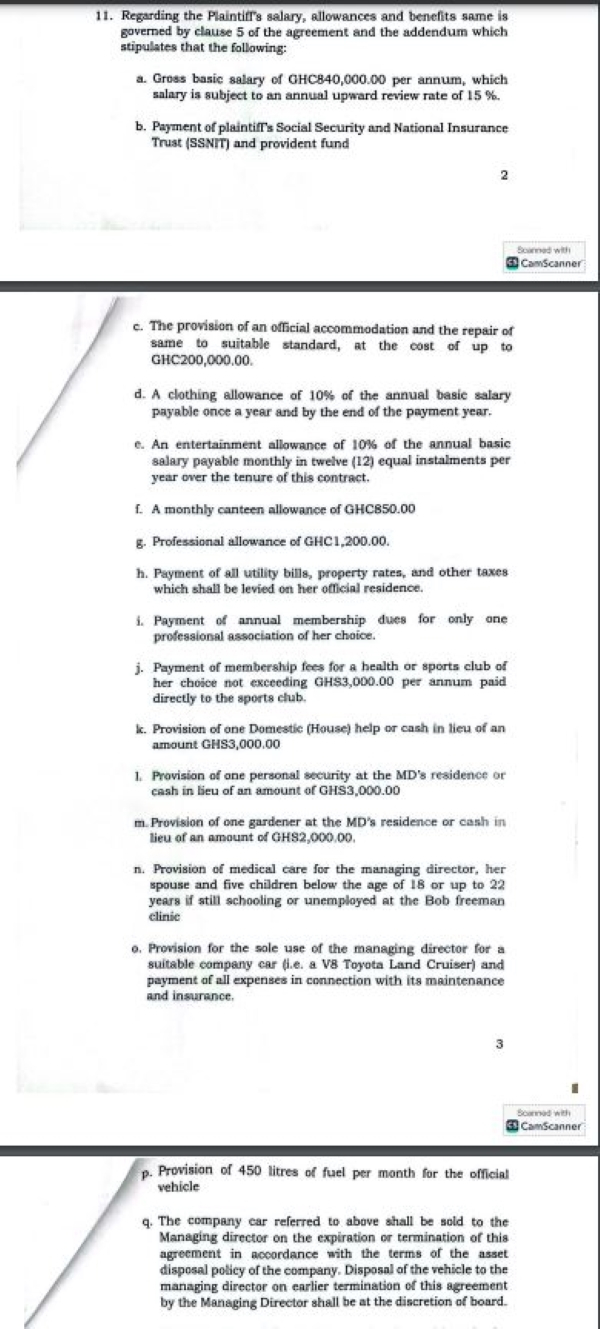

The lawsuit also highlights the financial implications of her termination. Under the terms of her contract, Duah-Yentumi is entitled to a lump sum payment of her gross salary, allowances, and benefits for the unexpired period of her tenure.

“The plaintiff further states that upon the termination of her employment, she is entitled, in accordance with clause 7 of the agreement, to a lump sum payment of her gross salary, allowances, and benefits for the unexpired period of the agreement, which payment must be made at the ‘official handing over to the next successor,’” the suit adds.

Her employment agreement provided her with significant benefits, including a 30-day paid annual vacation, an annual familiarization tour with a $3,000 airfare allowance, a per diem of $810 for international travel, and a personal accident and life insurance cover equivalent to five times her annual basic salary.

These benefits were subject to an annual 15% increment review.

“Duah-Yentumi’s legal team is seeking an order for the defendants to pay her entire salary and benefits for the unexpired term of her contract, as well as any other relief the court deems appropriate.

“The Managing Director shall be entitled to an annual familiarization tour to any destination. SIC shall pay an amount not exceeding US$3,000 for an air ticket for the trip upon proof of undertaking the trip. The annual familiarization benefit is a ‘use it or lose it’ benefit.

“The Managing Director’s annual familiarization tour shall be considered part of her entitled paid vacation days each year and therefore should be deducted from the total entitled days when taken.

“The Managing Director shall be paid a per diem of US$810 for all international travels for seven (7) days towards the familiarization tour referred to in section 5.3(d). The payment shall commence before her departure,” the suit further states.

The case has drawn significant attention as it raises questions about corporate governance, contractual obligations, and the role of external authorities in the management of publicly listed companies.

The defendants in the case are SIC Insurance PLC, a company limited by liability and listed on the Ghana Stock Exchange, and James Agyenim-Boateng, a lawyer and politician residing within the jurisdiction of the court.

See photos of the suit below:

ID/MA

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel