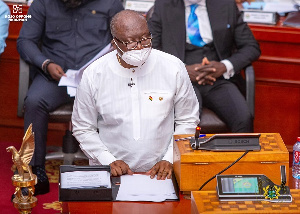

Finance Minister, Ken Ofori-Atta

Finance Minister, Ken Ofori-Atta

Government introduces an electronic transaction levy

All online transactions will be taxed

E-levy to widen the tax net

E-levy is a tax that is imposed on financial transactions that are performed online or electronically. The tax however is applicable to originators of transactions on electronic platforms.

During the presentation of the 2022 budget by the Finance Minister, Ken Ofori Atta, it was disclosed that from January 2022, Ghanaians will be taxed to pay a 1.75% rate on all online monetary transactions including inward remittances.

These electronic platforms include fintech, online banking and momo platforms, etc.

In Ghana, the tax applies to every transaction above GHS 100 on a daily basis. That is, after, every GHS 100 (cumulative spend) the e-levy will be applied.

For example, if Kofi sends GHS 50 to his sister in the morning and sends another GHS 5O (totally GHS 100) to his brother in the afternoon, he will not pay the E-levy. However, any other payment after, this threshold, will attract the e-levy.

All Person to Person (P2P) mobile transactions (i.e. sending of funds to another account, payment for goods and services, payment of utilities (NB: that all government fees and charges; are exempt)

All POS/Merchant payments; Bank transfers, but moving money from one’s personal account to another personal account in a different bank is exempt from E-Levy; and all inward remittances. For inward remittances, the 1.75% rate will be applicable to the recipient of the funds.

(Also, personal bank transfers, i.e transfer between own accounts are exempt for the E-Levy)

The E-levy will take effect from 1 January 2022.

Government, through the Ghana Revenue Authority, will collect the E-Levy in

collaboration with the Telcos, Fintechs, and Financial Institutions.

The government justifies the introduction of the E-levy, stating that the increased growth in mobile money transactions poses a possible threat to government tax income.

This is because Digital payment systems are currently largely untaxed, and while the industry grows, most government tax revenue sources are seeing a decline in growth.