The policy will cost the government an estimated revenue of GH¢120 million

The policy will cost the government an estimated revenue of GH¢120 million

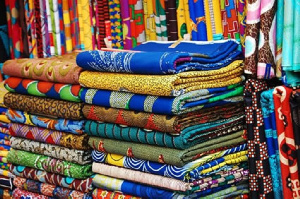

The Association of Ghana Industries (AGI) wants the government to extend the zero Value-Added Tax (VAT) regime for textile manufacturers beyond the December 2021 deadline.

The three-year zero-rate was passed as part of measures to revive the once buoyant domestic textile industry after it suffered from the influx of pirated and cheap products onto the market.

The policy will cost the government an estimated revenue of GH¢120 million over the period. Despite the expected revenue loss to the state, the policy’s introduction has so far contributed greatly to stabilizing the industry.

And with the sector still not completely out of its woods, the AGI is urging the government to extend the policy.

Among other things, it said, an extension will provide more time for the industry to fully recover and to be competitive within the AfCFTA market.

“We urge the government to extend the zero VAT regime for local textile manufacturers beyond the end of 2021,” its Vice President Humphrey Dake, said in Accra.

The AGI holds the view that textiles should be a key part of the country’s agenda for the continental free trade area and that a VAT exemption will inure to the benefit of the economy in the long run.

Without this, the association fears the sector might collapse and the modest gains made may be eroded.

Meanwhile earlier this year, Secretary of the Coalition of Textile Workers in Ghana, John Ackon, told the B&FT that the three-year zero VAT rate for the industry was timely and that it came at a time when the industry was in a state of ‘coma’.

“The zero VAT has been extremely beneficial. At the time it was introduced, some companies were folding up. Even with its introduction, some companies are struggling; ATL and Juapong Textiles are still finding their feet. There are other companies that are not able to pay their workers to date. COVID-19 worsened our plight; some companies were about to peak up, but the pandemic wiped out all the gains they made,” Mr. Ackon said.

Extension period

As a result of the tough challenges faced during the last two years, the sector was not able to benefit from the expected gains.

The AGI said it has therefore begun discussions with the Ministry of Finance, together with other stakeholders in the sector, for a possible two-year extension of the zero VAT rate.