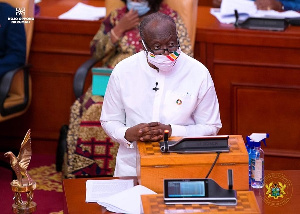

Finance Minister, Ken Ofori-Atta will in the coming deliver a mid-year review of the 2021 budget

Finance Minister, Ken Ofori-Atta will in the coming deliver a mid-year review of the 2021 budget

Despite some gradual increases over the past two decades, Ghana’s tax-to- GDP ratio – which stood at 13 percent in 2019 – remains below that of many countries with a comparable income level; largely due to ineffectiveness of the current tax policy designs of personal income and general sales tax revenues.

A survey conducted by the Institute for Fiscal Studies’ (IFS) Centre for Tax Analysis in Developing Countries (TaxDev) and the Tax Policy Unit in the Ministry of Finance revealed that while corporate tax revenues have grown noticeably in recent years, personal income tax and VAT revenues have stalled relative to GDP; and international comparisons are suggestive that collections for these two taxes in Ghana are relatively low given the tax rates in place.

Ghana’s tax revenue remains far below government’s target of 20 percent of GDP by 2023. Out of a sample 35 countries from sub-Saharan Africa in the International Centre for Tax and Development (ICTD) and the United Nations University World Institute for Development Economics Research (UNU-WIDER) Government Revenue Dataset (GRD), Ghana ranks 17th for 2018 in terms of tax-to-GDP ratio. Among lower-middle-income countries (including those in SSA), the country ranks 26th out of 36.

Findings from the survey attributed the decline in revenue collections partly to changing the GETFund Levy (GETFL) and National Health Insurance Levy (NHIL) into ‘straight levies’ which cannot be reclaimed, and the introduction of VAT withholding.

VAT revenues relative to GDP have barely increased over the period, once combined with NHIL and GETFL revenues – which have effectively functioned as an additional VAT for much of the period – the overall growth is from 2.3 to 3.6 percent of GDP.

For VAT, the most significant changes include an effective 5 percent point increase between 2000 and 2003; including the introduction of NHIL and earmarking of 2.5 percent points of VAT to the Ghana Education Trust Fund. More recently, the conversion of NHIL and decoupling of the GETFL into ‘straight levies’, which cannot be reclaimed by businesses, was another notable shift in VAT-related policy.

However, according to the Ghana Revenue Authority’s (GRA) tax collection data, VAT revenues have not increased at all since 2014. There has been an increased role played by domestically collected revenues in indirect taxes – particularly over the last couple of years as revenues collected at Customs have stalled comparatively.

In the case of Personal Income Tax (PIT), during 2016 government introduced an individual capital gain that has become subject to PIT. In 2018, a new top marginal rate of 35 percent for incomes over GH¢120,000 was introduced; while in 2019 the top income tax threshold increased from GH¢120,000 to GH¢240,000, and the rate decreased from 35 to 30 percent.

In terms of PIT, tax revenue in Ghana is lower than many comparative countries in sub-Saharan Africa (SSA) but slightly above the median of other lower-middle-income countries. However, for general sales taxes, Ghana’s revenues are noticeably lower. While the median SSA and other lower-middle-income countries collected general sales tax revenues of over 4.9 and 6.8 percent of GDP respectively, for Ghana this figure was 3.6 percent in 2019.