The new proposal is for MPs to enjoy $13.3m tax waivers on importing their cars

The new proposal is for MPs to enjoy $13.3m tax waivers on importing their cars

• A new proposal to Parliament for tax waiver on importation of cars for MPs has been handled

• The waiver will total a whooping US$13.3 million

• This is besides the fact that MPs will only pay back 40% of the loans they receive

A tax waiver of US$13.3 million has been tabled before Parliament to cover all importation of cars for Members of Parliament and Council of State members.

This is coming up as an add-on benefit for the officials after the loan facilities being worked on by the government, through the National Investment Bank, for them, a citinewsroom.com report has indicated.

It must be noted too that of the loan facility of US$28 million, for instance for MPs, they will only pay up forty percent of the monies used in the purchase of the cars.

By this arrangement, each MP is expected to receive $100,000, while members of the Council of State will get an accumulated US$3.5 million.

The Minister for Chieftaincy and Religious Affairs, Ebenezer Kojo Kum, laid this before Parliament on behalf of Ken Ofori-Atta, on Wednesday, July 14, 2021, the report said.

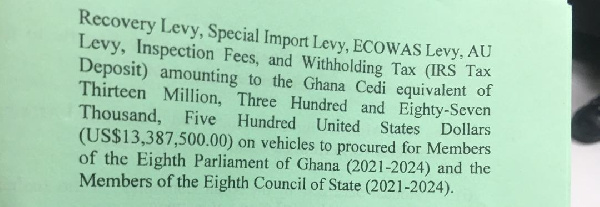

“Request for waiver of the Import Duty, Import GETFund Levy, Import NHIL, Import VAT, EXIM levy, COVID-19 Recovery Levy, Special Import Levy, ECOWAS Levy, AU Levy, Inspection Fees, and Withholding Tax (ITS Tax Deposit) amounting to the Ghana Cedi equivalent of thirteen million, three hundred and eighty-seven thousand, five hundred United States Dollars (US$13,387,500.00) on vehicles to be procured for Members of Parliament of the Eighth Parliament of Ghana (2021-2024) and the Members of the Eighth Council of State (2022-2024),” contents of request stated.