Dr. John Kwakye, Director of Research at the IEA

Dr. John Kwakye, Director of Research at the IEA

Consumer confidence in the economy appears to be on the ascendancy, particularly buoyed by the success in curbing the spread of COVID-19, as well as the expectation that previously-existing and newly-introduced government policies will prove effective, the Institute of Economic Affairs (IEA) has stated.

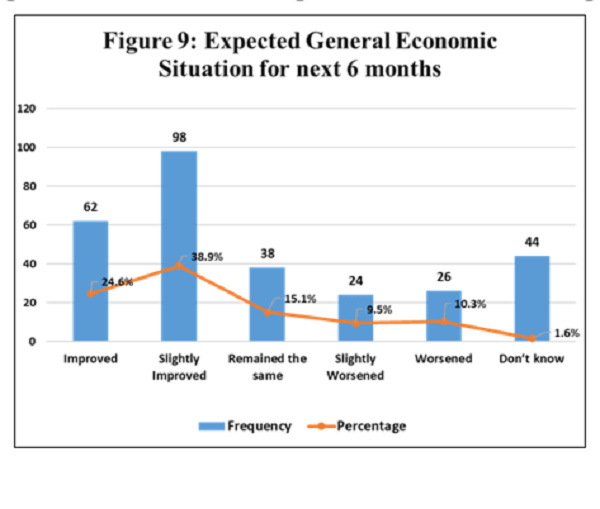

This disclosure was contained in a recently released report on its first Consumer Confidence Survey for 2021, which showed a significant majority of respondents – 63.5% – expect the national economic situation to improve over the course of the year as compared to 19.8% who expect it to worsen.

The survey, conducted between March 30 and April 2, was hampered in its scope and size due to limitations occasioned by the ongoing pandemic. it pooled data from 252 respondents in the Makola market; Kwame Nkrumah Circle; Ashaiman Market; University of Ghana campus; and the Accra Mall axis of the Accra-Tema metropolis.

Data from interactions with the largely youthful sample, which had 76% of respondents within the 18 to 37-year bracket, most of whom were male – 51.8%; and showed that for a relative majority (44.2%), their economic situation had worsened in the last six months compared to the preceding six months, while 34.3% claimed to have seen improvement.

This, the Institute says, is consistent with the fact that the pandemic had generally been more severe in the last six months compared to the preceding six months, with the latter period being accompanied by tighter restrictions.

“For those who expected the economic situation to improve in the next six months, a relative majority – 38% – attributed their optimism to expected improvement in the COVID-19 situation. This group was followed by 27% whose reason was the expected effect of policies already implemented by government; and 24% who cited the effect of new government policies,” the report reads in part.

Gender imbalance

The informal economy was predominant, as evidenced by the relatively high proportion of respondents – 44.1% – who were self-employed. More telling, however, is the disparity between the effects of the pandemic and expectations for recovery by women, who dominate the informal sector.

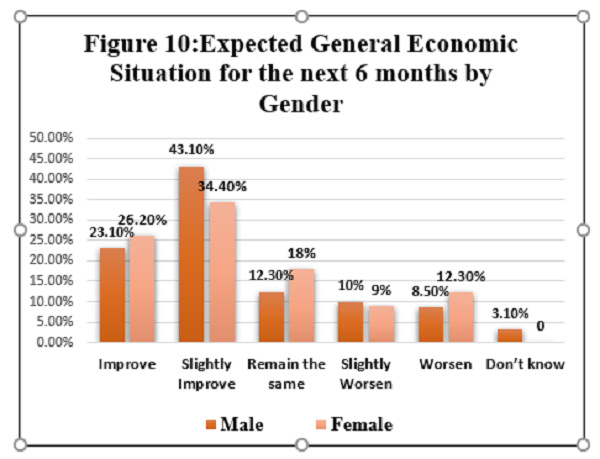

While much has been said and written about the pandemic’s impact on the livelihoods of women, the survey showed that a higher percentage of females – 47.1% – had seen their economic situation worsen compared to 41.6% of males.

Additionally, a relatively lower proportion of women – 60.6% – expressed optimism for improvement of the economy, versus 66.2% of men. Conversely, a higher percentage of females – 21.3% – expected the economic situation to worsen compared to 18.5% of males. Generally, younger persons were more optimistic about the economic outlook.

Reactions

Offering justification for the timing and scope of the survey, the Director of Research at the IEA, Dr John Kwakye, argued that the survey was conducted at a critical juncture in the pandemic-era recovery period. He added that the Accra-Tema metropolis was selected due to its large, dense and diversified population.

“We concede that this edition of the survey is quite limited; however, we believe that the insights from this Survey gives us a reflection of the current sentiments and will prove invaluable when making future analyses,” he said at a roundtable discussion on results of the survey – where he gave assurance that future surveys will extend to the whole country as the situation normalises.

Dr Kwakye added that policymakers must move away from rhetoric to evident action in their commitment toward strengthening the informal economy and empowering women-led businesses.

“The pandemic has given us fair warning; it is in our collective interest to make these adjustments now before we are faced with an even sterner test,” he cautioned.

He added that the Institute is looking forward to formalising its surveys for consumers and businesses into an Index, which will complement that which is conducted by the Bank of Ghana.